estate tax changes build back better

President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. Proposed Build Back Better Act Includes Tax Changes Significantly Impacting Estate Planning.

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the.

. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. The House Ways and Means Committee approved President Bidens. The House of Representatives on Friday morning passed HR.

Understand the different types of trusts and what that means for your investments. The BBBA proposal seeks to reduce these. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1 2022.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. 5376 the Build Back Better Act by a vote of 220213. November 5 2021.

December 3 2021. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. Ad Four Simple Steps - Estate Planning Recommended - We Can Help.

Ad Settling a loved ones estate can be time consuming. President Bidens Build Back Better Act BBBA has made a significant first step towards passage as the House Ways and. Ad Settling a loved ones estate can be time consuming.

Build Back Better Act and Estate Planning Changes. Empowering executors to think clearly. Find out whats ahead with your custom roadmap.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been. On September 13 2021 the House Ways and Means Committee released a proposed tax bill. Ad Fisher Investments has 40 years of helping thousands of investors and their families.

These proposals are currently under. Find out whats ahead with your custom roadmap. 5376 would revise the estate and gift tax and treatment of trusts.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. The estate planning community got some very good news on October 28 2021. November 5 2021.

Heres what you need to. Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross income of a trust or estate. By Taylor Lihn PLLC.

Get Matched With A Qualified Estate Planning Lawyer For Free. Empowering executors to think clearly. The bill encompasses a wide range of budget and.

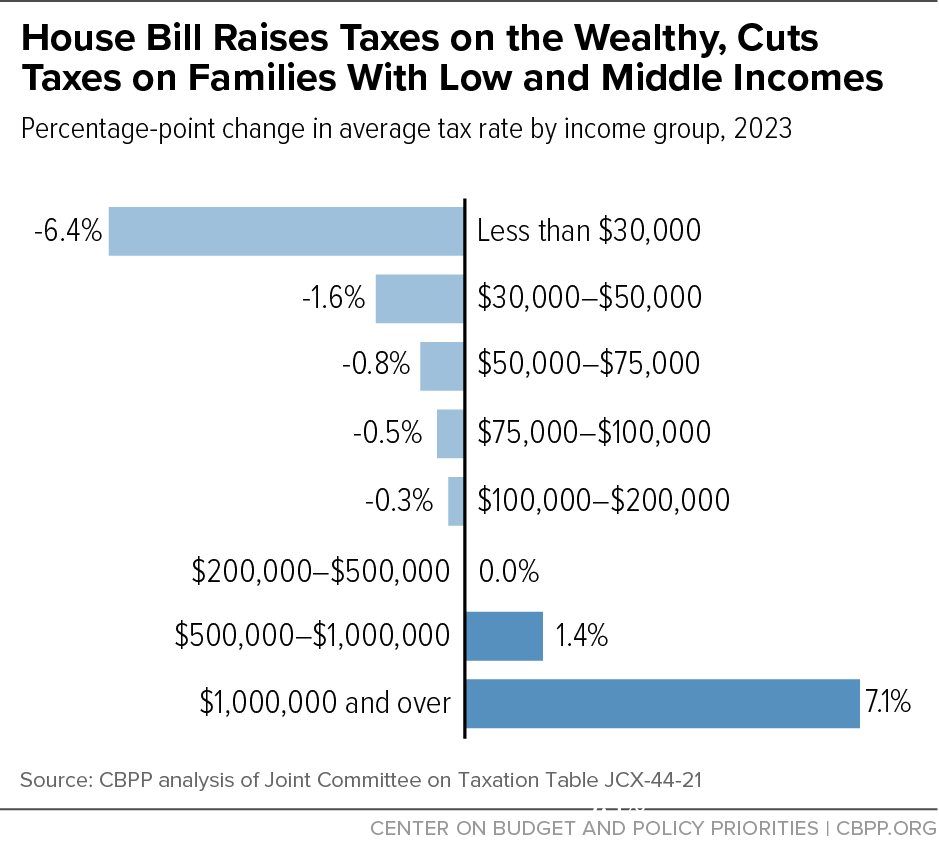

The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax if the MAGI exceed 25 million. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. Were here to make it easier.

Significant Estate Gift and Income Tax Changes Proposed Under The Build Back Better Act. Were here to make it easier. Deferred Retainers available upon qualification.

The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust. The Effects of the Build Back Better Act on Estate Planning. No Legal Fees upfront upon qualification.

On September 13 2021 the Chairman of the House Ways and Means Committee released the. Day Pitney Co-author s Stephen Ziobrowski Tasha K.

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Biden Budget Biden Tax Increases Details Analysis

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

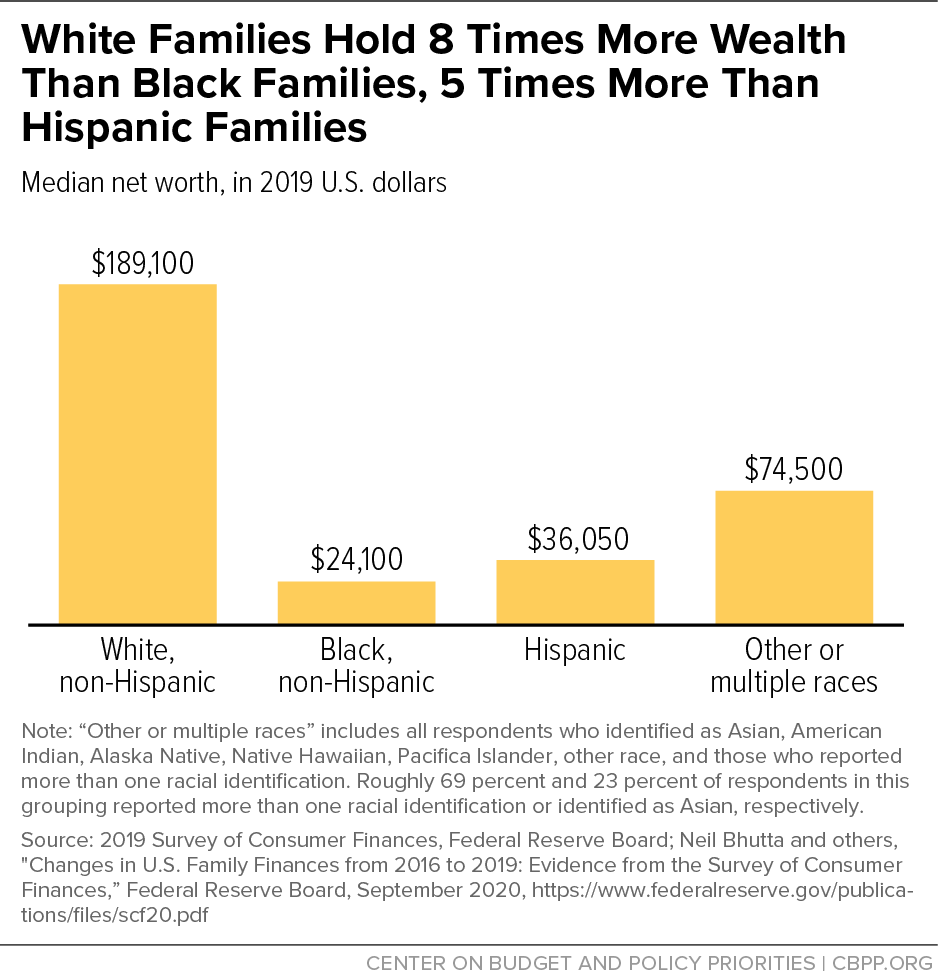

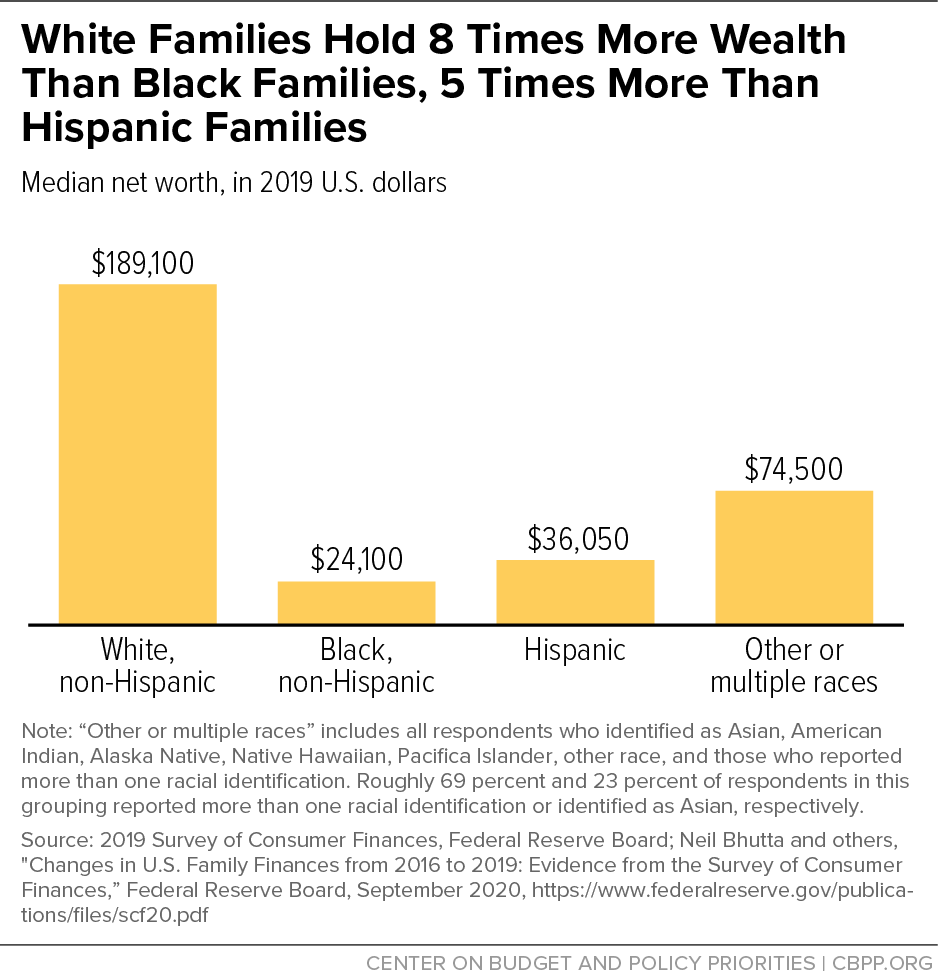

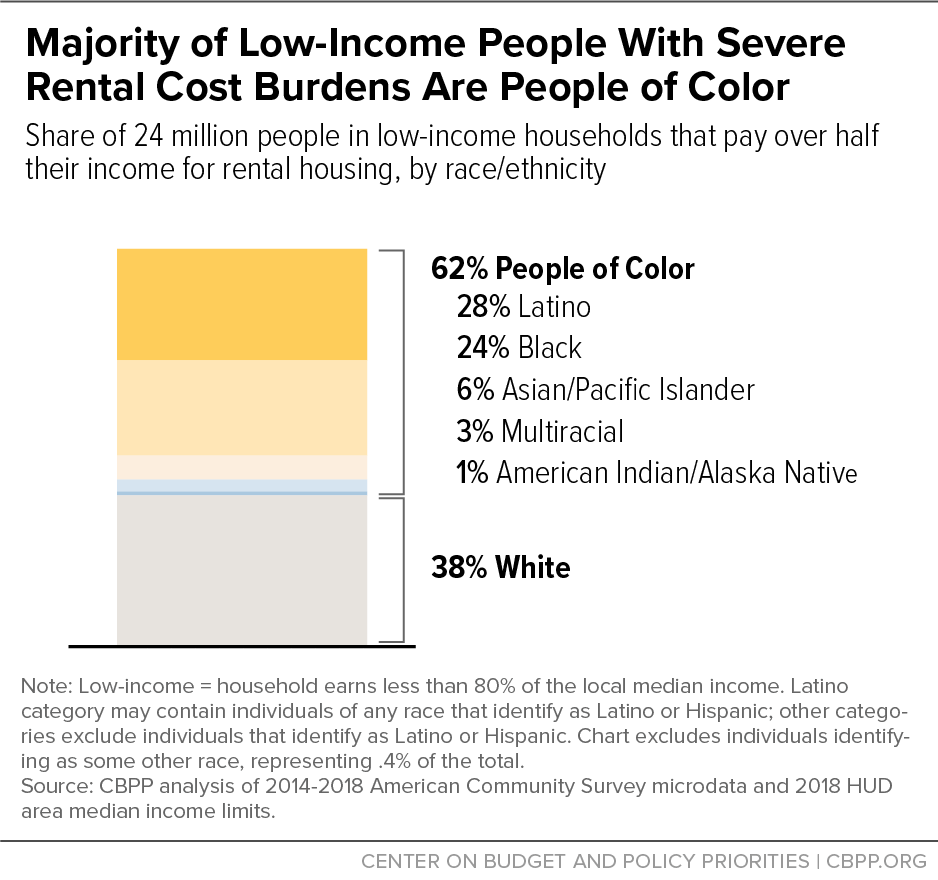

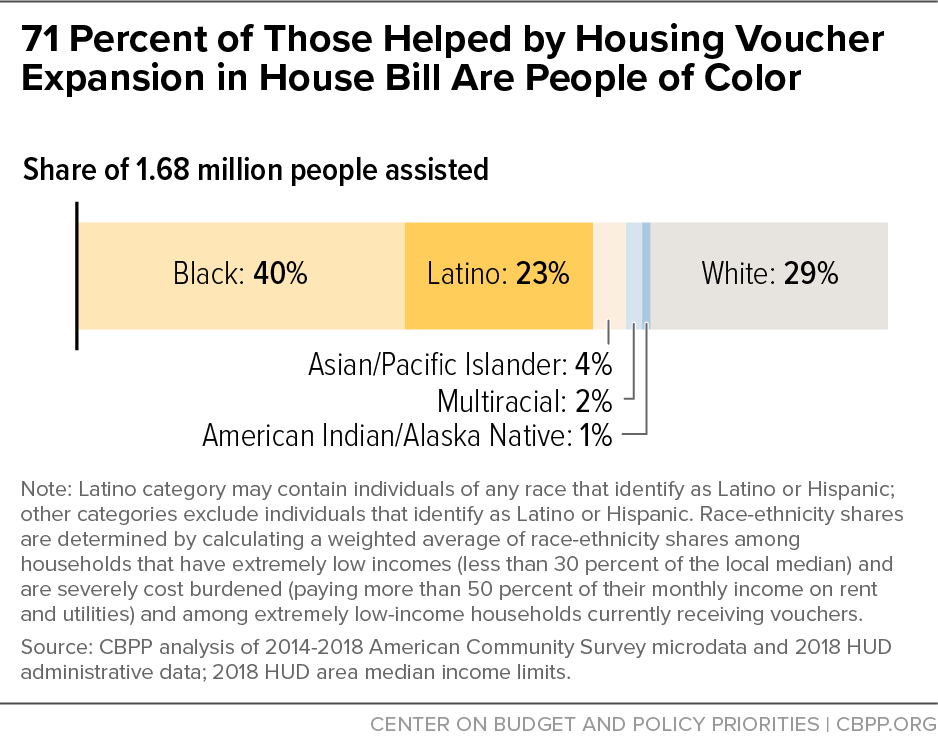

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Why This Tax Provision Puts Democrats In A Tough Place Time

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

The Build Back Better Act Transformative Investments In America S Families Economy House Budget Committee Democrats

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Can Congress Still Pass Some Of Biden S Climate Ideas This Year Los Angeles Times

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

/cdn.vox-cdn.com/uploads/chorus_asset/file/23907314/1411461197.jpg)

Biden S Climate Plan Is Back And It S All About Building Things The Verge

Fact Check 97 Percent Of Small Businesses Exempt From Biden Tax Plan

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Whatever This Is It Won T Be Build Back Better

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times