property tax in france 2020

French company tax rates. Tuesday 10 November 2020.

French Property Tax Considerations Blevins Franks

More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues.

. Wealth tax in France is payable by resident households where the total worldwide assets exceed 1300000. Tax measures in stimulus plan. The company tax rate is 28 for profits up to 500k Euros and 3333 above this.

As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2020 is 49. April 19 2022 Taxes for freelancers and self-employed workers in France. President Macron made it an election pledge to abolish the taxe dhabitation for 80 of French households.

Reduction to local production taxes proposed. Owners are liable for a tax based. The deadline for paper declarations is Friday 12th of June 2020.

Inheritance and estate taxes in France. The rates for the year 1 January to 31 December 2020 are 28 on the first EUR 500000 and 31 on the excess. About 20 tax on a 100 purchase.

You receive your tax notification directly by post. Over the past two years. Taxe dhabitation is a residence tax.

The French property tax for house occupiers taxe dhabitation Taxes for house owners taxe. And taxe foncière property tax. Exact tax amount may vary for different items.

Married Joint Tax Filers. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on. An estate tax is levied on the property of the deceased and is paid by the estate itself.

Tax measures in stimulus plan. France spent 2092 billion euros on healthcare in 2020 or about 3100 euros per person 04 per cent less than the year before. Real property tax - Rental income for residential apartments are taxed at the normal PIT rates after the deduction of all the expenses borne by the landlords.

You also have the possibility to pay and. The current France VAT Value Added Tax is 2000. The rate from 1 January 2021 is 275 for all income.

Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence. Local taxes In France there are essentially two local taxes called. March 31 2022 International.

Impôt sur les sociétés. If you are filing for the first time youll need to ask your local tax office for a paper form to complete. Here is a list of the other types of taxes you may have to pay while in France.

Tax on 2021 profits. Inheritance taxes in contrast are only levied on the value of assets transferred and are. For example if you left France in 2020 you would need to file an income tax return in 2021 with the Tax Department with which you dealt prior to your departure.

Individual taxes are one of the most prevalent means of raising revenue to fund government across the OECD. In the French budget published in September 2020 the French Government. If you are an expat resident in France or alternatively own property there it is of.

The VAT is a sales tax that applies to the. 108 rows Taxe Foncière 2020. Individual income taxes are levied on an.

Tuesday 10 November 2020. This is the lowest increase ever. Individual Taxation in France.

Taxes In France A Complete Guide For Expats Expatica

Unsecured Property Tax Los Angeles County Property Tax Portal

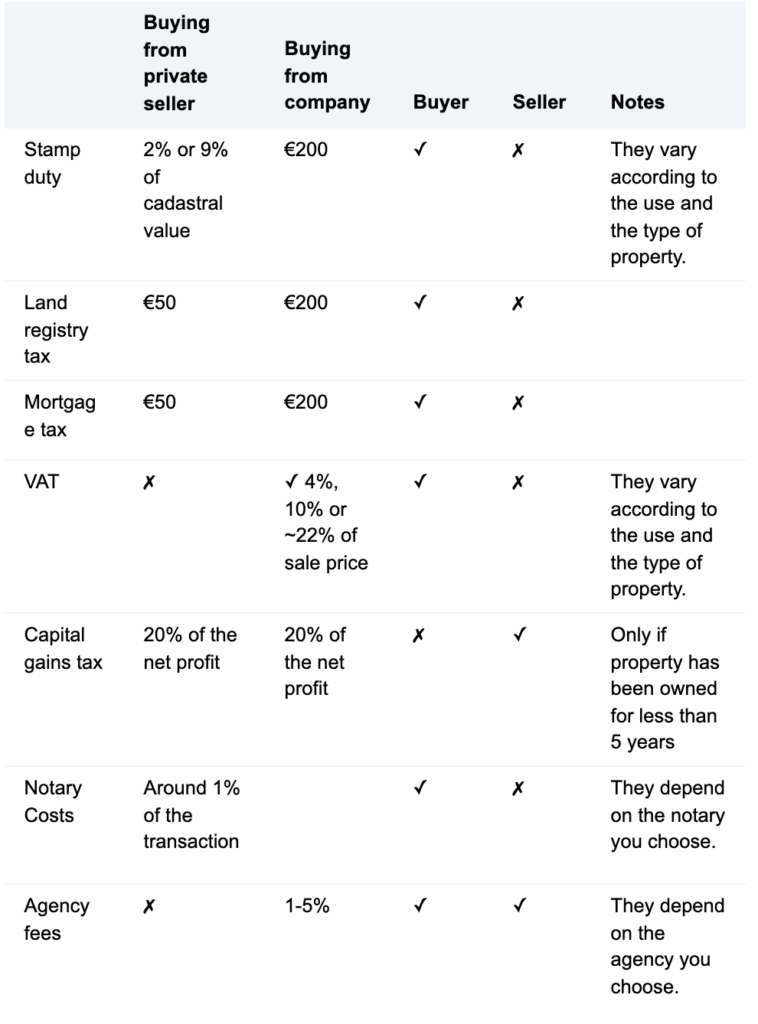

French Taxes I Buy A Property In France What Taxes Should I Pay

Crypto News From Japan Jan 13 17 In Review Security Token Cryptocurrency Trading Chinese News

Pin By Rijon On Good Inheritance Smoke Bomb Photography Inheritance Tax

Feature Your Property At Europe S Premier Real Estate Event Real Estate Commercial Real Estate Estates

French Taxes I Buy A Property In France What Taxes Should I Pay

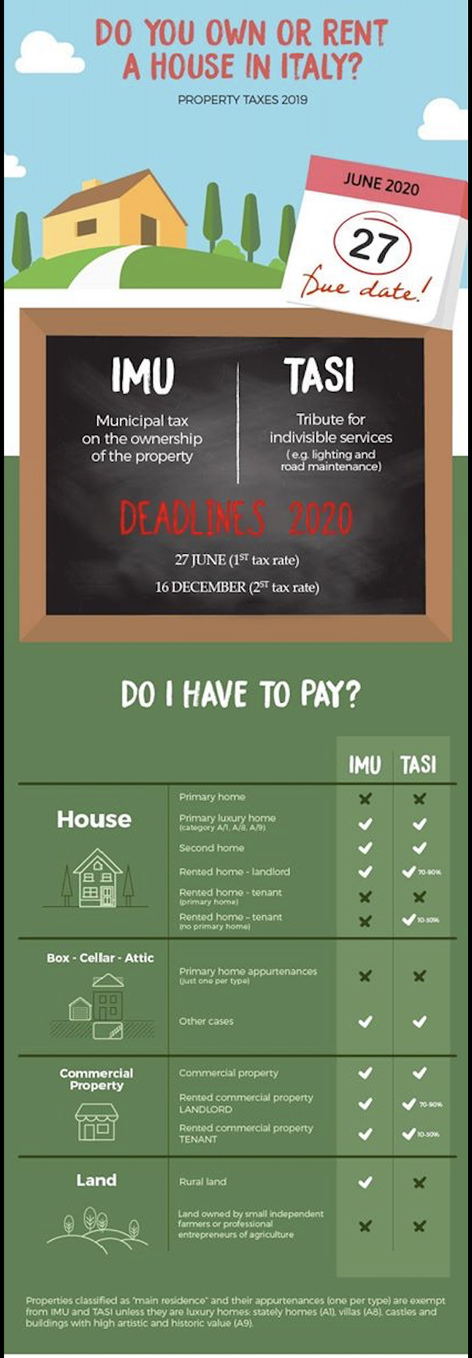

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Taxe D Habitation French Residence Tax

Taxes In France A Complete Guide For Expats Expatica

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

In Depth Guide To French Property Taxes For Non Residents Expats

Local Property Taxes In Paris Among The Lowest In The World And Unchanged For The 6th Year Paris Property Group

French Property Prices Analysis Of The Market Notaries Of France

Property Tax In Italy The Ultimate Guide For 2020 Accounting Bolla

Pin By Pauline Straker On France House Move Moving House Agree Helpful

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax County

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax